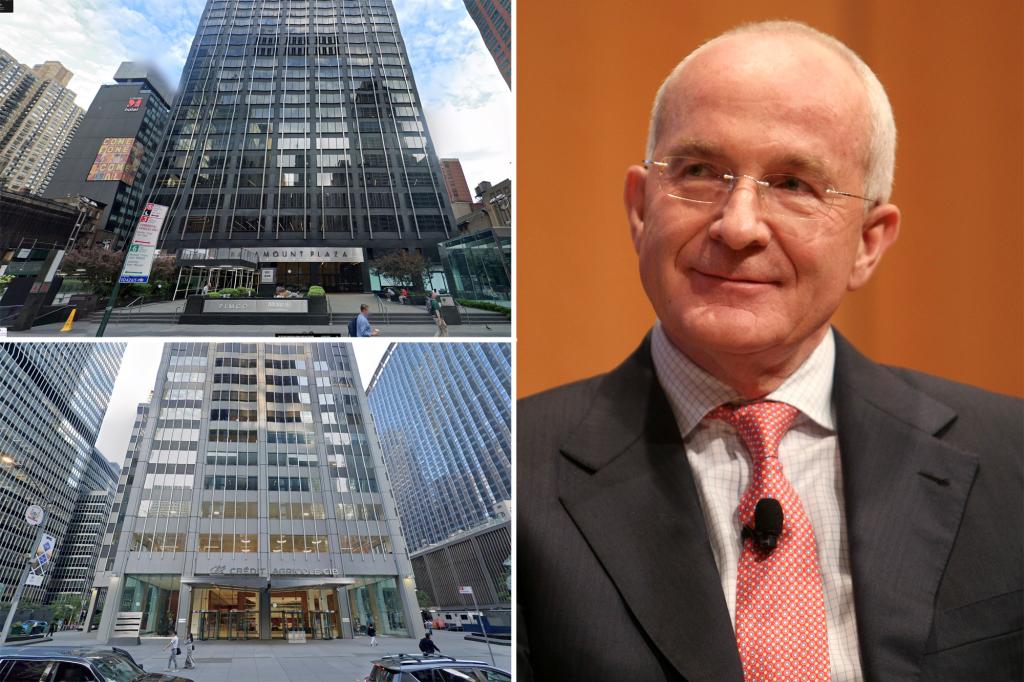

In the ever-evolving landscape of commercial real estate, Paramount Group Inc. (NYSE: PGRE), a leading real estate investment trust (REIT) specializing in high-quality office properties in New York City and San Francisco, delivered a compelling performance during its second quarter of 2025. The earnings call, held on July 31, 2025, showcased resilient operations amid lingering market challenges, with particular emphasis on robust leasing momentum and strategic transactions that underscore the company’s adaptive strategy. As urban office markets continue to recover from post-pandemic shifts, Paramount’s results highlight a blend of optimism and pragmatism, driven by strong tenant demand in premium assets.

Financially, the quarter presented a mixed picture, reflective of broader sector dynamics. Paramount reported a net loss attributable to common stockholders of $19.8 million, or $0.09 per diluted share, compared to a net loss of $7.8 million, or $0.04 per share, in the prior year’s quarter. This widening loss was partially attributed to $7.5 million in non-recurring expenses related to the acceleration of equity awards and severance payments. However, the core metric for REIT investors—Core Funds from Operations (Core FFO)—stood at $36.9 million, or $0.17 per diluted share, down from $43.4 million, or $0.20 per share, year-over-year but still surpassing analyst consensus by $0.03 per share.

A standout highlight of the earnings call was the company’s exceptional leasing activity, which hit its highest quarterly volume since 2019. Paramount executed leases totaling 404,710 square feet in Q2, with the company’s share amounting to 255,621 square feet at a weighted average initial rent of $91.93 per square foot.

key markets: approximately 52% in New York and 48% in San Francisco.